Analyzing the Top DeFi Projects of 2024

- Introduction to Decentralized Finance (DeFi)

- Evaluating the Evolution of DeFi Platforms

- Top DeFi Projects to Watch in 2024

- Comparing DeFi Protocols for Yield Farming

- Challenges and Opportunities in the DeFi Space

- Future Trends in Decentralized Finance

Introduction to Decentralized Finance (DeFi)

Decentralized Finance (DeFi) has emerged as a revolutionary concept in the world of finance, offering a new way to conduct financial transactions without the need for traditional intermediaries such as banks or brokers. DeFi projects leverage blockchain technology to create a decentralized ecosystem where users can access a wide range of financial services, including lending, borrowing, trading, and more.

One of the key advantages of DeFi is its ability to provide financial services to individuals who may not have access to traditional banking systems. By eliminating the need for intermediaries, DeFi projects can offer lower fees, faster transaction times, and greater transparency compared to traditional financial institutions.

In recent years, the DeFi space has seen tremendous growth, with a multitude of projects emerging to cater to different financial needs. These projects vary in terms of their offerings, technology, and governance structures, providing users with a diverse range of options to choose from.

As we delve into the top DeFi projects of 2024, it is essential to understand the underlying principles of DeFi and how these projects are reshaping the financial landscape. By exploring the innovative solutions offered by these projects, we can gain valuable insights into the future of finance and the potential impact of decentralized technologies on the global economy.

Evaluating the Evolution of DeFi Platforms

When evaluating the evolution of decentralized finance (DeFi) platforms, it is crucial to consider the advancements and changes that have taken place in the industry. DeFi projects have undergone significant transformations over the years, with new features and functionalities being introduced to meet the growing demands of users. One of the key aspects to analyze is the scalability of DeFi platforms, as this determines their ability to handle a large number of transactions efficiently.

Another important factor to consider is the security measures implemented by DeFi projects to protect users’ funds and data. With the increasing number of hacks and security breaches in the DeFi space, it is essential for platforms to prioritize security and implement robust measures to safeguard their users’ assets. Additionally, the user experience offered by DeFi platforms plays a crucial role in their success, as a seamless and intuitive interface can attract more users and drive adoption.

Furthermore, the interoperability of DeFi platforms with other blockchain networks and protocols is becoming increasingly important, as it allows for seamless integration and communication between different platforms. This interoperability enables users to access a wider range of services and products, ultimately enhancing the overall DeFi ecosystem.

Top DeFi Projects to Watch in 2024

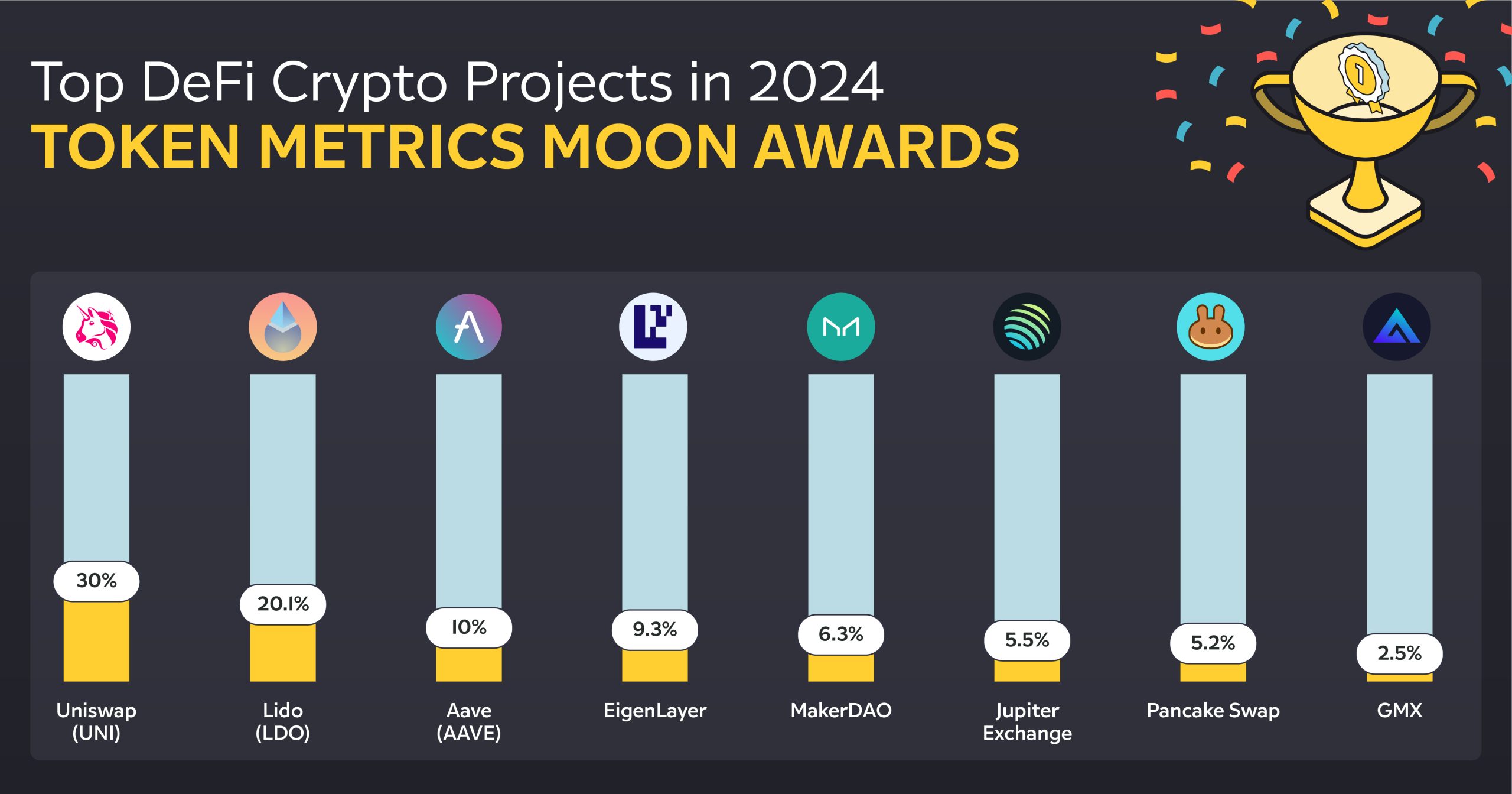

When it comes to the top DeFi projects to keep an eye on in 2024, there are several promising options that have been gaining traction in the decentralized finance space. These projects are pushing the boundaries of what is possible in the world of finance and are worth watching as they continue to innovate and grow.

- Ethereum: Ethereum remains a dominant player in the DeFi space, with its smart contract capabilities and large developer community. The platform continues to be a hub for decentralized applications and financial services.

- Polkadot: Polkadot is another project to watch, as it aims to enable different blockchains to transfer messages and value in a trust-free fashion. Its interoperability features make it an attractive option for DeFi projects looking to collaborate across different networks.

- Solana: Solana has been gaining attention for its high-speed transactions and low fees, making it a popular choice for DeFi projects that require fast and cost-effective transactions. Its scalability and performance have positioned it as a top contender in the DeFi space.

- Chainlink: Chainlink’s decentralized oracle network plays a crucial role in connecting smart contracts with real-world data. As DeFi projects continue to rely on accurate and timely information, Chainlink’s services are in high demand.

- Uniswap: Uniswap is a decentralized exchange that has been at the forefront of the DeFi movement. Its automated market-making mechanism allows users to trade tokens without the need for a centralized intermediary, making it a popular choice for DeFi enthusiasts.

These are just a few of the top DeFi projects to watch in 2024, as the decentralized finance space continues to evolve and expand. Keep an eye on these projects as they navigate the ever-changing landscape of DeFi and push the boundaries of what is possible in the world of finance.

Comparing DeFi Protocols for Yield Farming

When it comes to yield farming in the world of DeFi, there are several protocols that stand out for their efficiency and reliability. Let’s take a closer look at some of the top DeFi projects of 2024 and compare them based on their yield farming capabilities:

- Project A: This protocol offers a wide range of yield farming opportunities with competitive APYs. Users can stake their tokens and earn rewards in a variety of cryptocurrencies.

- Project B: Known for its user-friendly interface, this protocol allows investors to easily participate in yield farming with minimal effort. The APYs may not be as high as some other protocols, but the simplicity of use makes it appealing to beginners.

- Project C: With a focus on security and audited smart contracts, this protocol is a popular choice for investors looking for peace of mind. The APYs are competitive, and the platform has a strong community support.

Each of these DeFi protocols has its own unique features and benefits for yield farmers. It’s important to research and compare them carefully before deciding where to allocate your crypto assets for yield farming. By understanding the differences between these protocols, you can make an informed decision that maximizes your returns in the DeFi space.

Challenges and Opportunities in the DeFi Space

The decentralized finance (DeFi) space presents a myriad of challenges and opportunities for investors and developers alike. As the industry continues to evolve and mature, it is crucial to stay abreast of the latest trends and innovations to capitalize on the potential growth.

One of the main challenges in the DeFi space is the issue of security. With the rise of hacks and exploits targeting various projects, investors must exercise caution and conduct thorough due diligence before committing their funds. Developers, on the other hand, face the challenge of building robust and secure protocols that can withstand malicious attacks.

On the flip side, the DeFi space also offers numerous opportunities for growth and innovation. With the advent of new technologies such as layer 2 solutions and cross-chain interoperability, developers can create more efficient and scalable DeFi platforms. Investors, on the other hand, can take advantage of the high yields and diverse investment options available in the DeFi ecosystem.

Future Trends in Decentralized Finance

The future of decentralized finance (DeFi) is poised for significant growth and innovation as we look ahead to 2024. Several trends are expected to shape the landscape of DeFi projects in the coming years:

- Increased interoperability: DeFi projects are likely to become more interconnected, allowing for seamless transactions and asset transfers across different platforms.

- Enhanced security measures: With the rise of cyber threats, DeFi projects will prioritize security to protect users’ funds and data.

- Integration of artificial intelligence: AI technology is expected to play a more prominent role in DeFi projects, enabling more efficient decision-making processes and risk management.

- Expansion of decentralized exchanges: DEXs are projected to gain more traction, offering users greater control over their assets and trading activities.

- Regulatory compliance: DeFi projects will likely focus on adhering to regulatory guidelines to ensure long-term sustainability and legitimacy in the financial market.

Overall, the future of DeFi looks promising, with continued innovation and advancements that will revolutionize the way we engage with financial services. By staying abreast of these trends, investors and users can position themselves to capitalize on the opportunities presented by the evolving DeFi ecosystem.