The Impact of the Latest Bitcoin Halving on the Market

- The Basics of Bitcoin Halving and Its Purpose

- Previous Bitcoin Halving Events and Their Effects

- Market Predictions Leading Up to the Latest Halving

- Impact of Bitcoin Halving on Miners and Mining Operations

- Price Volatility Post-Halving: What to Expect

- Long-Term Implications of the Latest Bitcoin Halving

The Basics of Bitcoin Halving and Its Purpose

Bitcoin halving is an event that occurs approximately every four years, during which the rewards that miners receive for validating transactions on the Bitcoin network are cut in half. This process is coded into the Bitcoin protocol to control the supply of Bitcoin and ensure that there will only ever be 21 million coins in existence. The purpose of Bitcoin halving is to prevent inflation and maintain the scarcity of the cryptocurrency, which in turn helps to increase its value over time.

Previous Bitcoin Halving Events and Their Effects

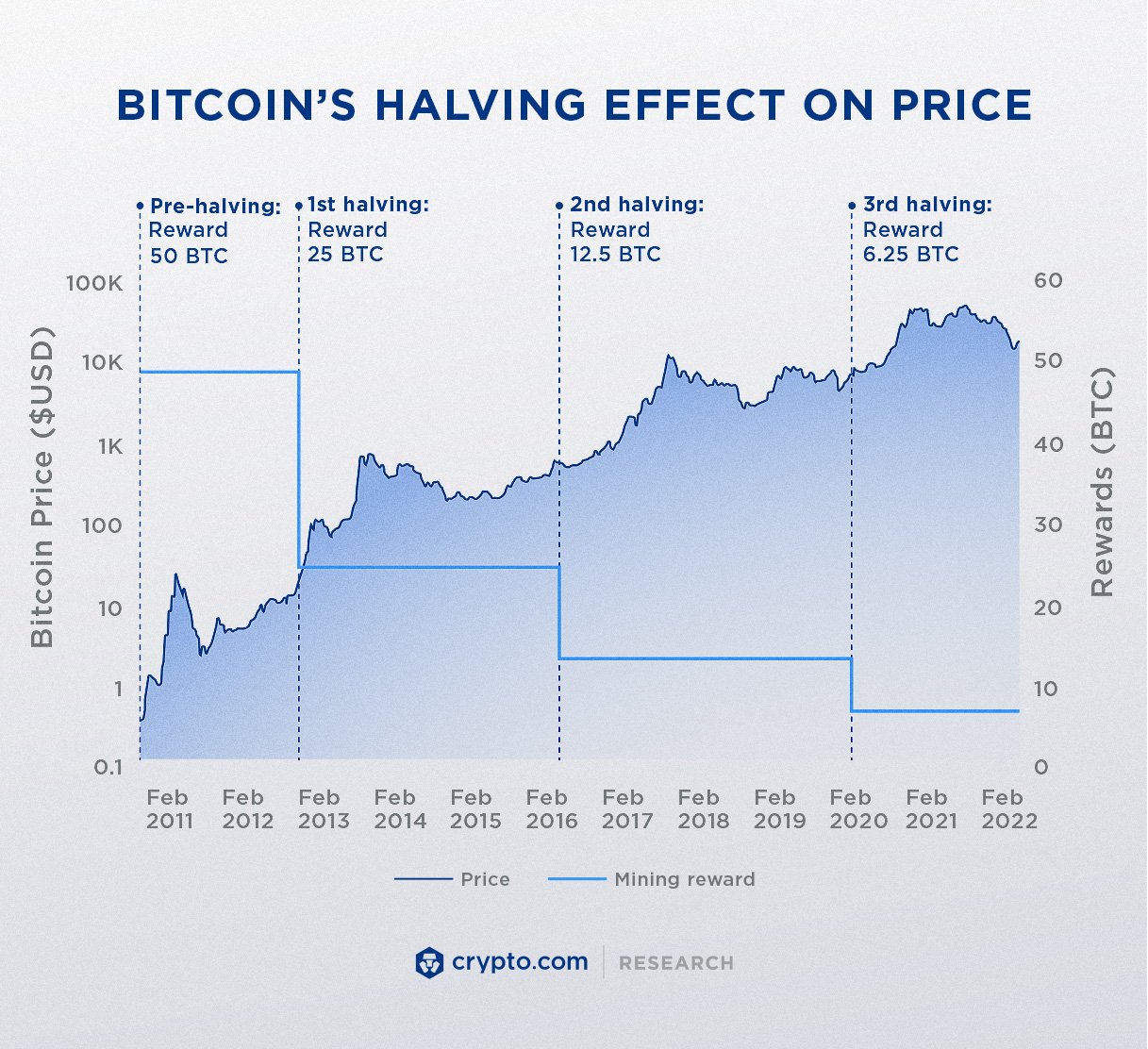

The previous Bitcoin halving events have had significant impacts on the market, leading to both short-term fluctuations and long-term trends. Here is a brief overview of the effects of the previous halving events:

1. **2012 Bitcoin Halving**:

– The first Bitcoin halving took place in November 2012, reducing the block reward from 50 BTC to 25 BTC.

– Following the halving, there was a gradual increase in the price of Bitcoin over the next few months.

– This event marked the beginning of a bull run that lasted for several years, with Bitcoin reaching new all-time highs.

2. **2016 Bitcoin Halving**:

– The second Bitcoin halving occurred in July 2016, cutting the block reward from 25 BTC to 12.5 BTC.

– In the months leading up to the halving, there was increased speculation and anticipation in the market.

– After the halving, Bitcoin experienced a period of consolidation before starting another bull run that culminated in the historic 2017 price surge.

3. **2020 Bitcoin Halving**:

– The most recent Bitcoin halving took place in May 2020, reducing the block reward from 12.5 BTC to 6.25 BTC.

– Leading up to the event, there was a mix of excitement and uncertainty among investors and traders.

– Following the halving, Bitcoin initially saw some volatility but eventually entered a new bullish phase, surpassing previous all-time highs.

Overall, the Bitcoin halving events have historically been associated with increased price volatility and market speculation. While the immediate effects may vary, the long-term trend has generally been positive for Bitcoin’s price and adoption. Investors and traders closely monitor these events as they can provide valuable insights into the future direction of the market.

Market Predictions Leading Up to the Latest Halving

The market predictions leading up to the most recent Bitcoin halving were mixed, with some experts forecasting a significant increase in the price of the cryptocurrency, while others were more cautious in their outlook. Many analysts pointed to historical data from previous halving events, which showed a pattern of price surges in the months following the event. This led to speculation that the same trend would continue this time around, driving up demand for Bitcoin and pushing its value higher.

On the other hand, some market observers warned that the hype surrounding the halving could lead to a “buy the rumor, sell the news” scenario, where investors who had bought Bitcoin in anticipation of the event would sell off their holdings once it had passed. This could potentially lead to a short-term drop in the price of Bitcoin, as the market corrected itself after the halving.

Overall, the market sentiment leading up to the latest halving was one of cautious optimism, with many investors keeping a close eye on the price of Bitcoin and preparing for potential volatility in the days and weeks following the event. While some believed that the halving would lead to a significant price increase, others were more skeptical and warned of the possibility of a market correction. Ultimately, only time would tell how the halving would impact the market and whether it would live up to the expectations of investors.

Impact of Bitcoin Halving on Miners and Mining Operations

Bitcoin halving has a significant impact on miners and their mining operations. The reduction in block rewards means that miners receive fewer bitcoins for verifying transactions. This can lead to a decrease in profitability for miners, as they are earning less for their efforts.

As a result of the halving, miners may need to reassess their operations and make adjustments to remain profitable. Some miners may be forced to shut down their operations if they are unable to cover their costs. This can lead to a decrease in the overall hash rate of the Bitcoin network, potentially impacting transaction processing times.

Miners may also need to upgrade their equipment to more efficient models in order to compete in the post-halving environment. This can lead to increased capital expenditures for miners, further impacting their bottom line. Additionally, miners may need to consider joining mining pools to increase their chances of earning rewards.

In conclusion, the Bitcoin halving has a direct impact on miners and their mining operations. It is essential for miners to adapt to the changing landscape to remain competitive and profitable in the long run.

Price Volatility Post-Halving: What to Expect

After the Bitcoin halving event, many investors are curious about the potential price volatility in the market. Historically, Bitcoin has experienced significant fluctuations in value following previous halvings. It is essential to understand what to expect in terms of price movements post-halving.

One possible scenario is a period of increased volatility as the market adjusts to the reduced supply of new Bitcoins. This could lead to sharp price swings in either direction as traders react to the changing dynamics of supply and demand. It is crucial for investors to be prepared for this potential volatility and to have a clear strategy in place to navigate the market effectively.

Another possible outcome is a period of relative stability as the market absorbs the impact of the halving event. This could result in a more gradual price movement as investors adjust their expectations and trading strategies accordingly. However, it is essential to remain vigilant during this time and to monitor the market closely for any signs of increased volatility.

Overall, the post-halving period is likely to be a time of heightened price volatility in the Bitcoin market. Investors should be prepared for the possibility of sharp price swings and have a clear plan in place to manage their investments effectively. By staying informed and proactive, investors can navigate the market successfully and capitalize on the opportunities presented by the latest Bitcoin halving event.

Long-Term Implications of the Latest Bitcoin Halving

The latest Bitcoin halving event has significant long-term implications for the cryptocurrency market. This reduction in the rate at which new Bitcoins are created has historically led to increased scarcity and, subsequently, higher prices. As a result, many investors and analysts are optimistic about the future of Bitcoin following this most recent halving.

One of the key long-term implications of the latest Bitcoin halving is the potential for increased demand. With fewer new coins entering circulation, existing Bitcoin holders may be less inclined to sell, leading to a supply shortage. This scarcity could drive up prices as more investors look to buy Bitcoin, anticipating future price appreciation.

Another important consideration is the impact of the halving on mining profitability. As the reward for mining new blocks is reduced, miners may need to become more efficient or seek alternative revenue streams to remain profitable. This could lead to consolidation in the mining industry, with larger players gaining a competitive advantage over smaller operations.

Furthermore, the latest halving may also have implications for the broader cryptocurrency market. Bitcoin’s price movements often influence the prices of other cryptocurrencies, so any significant changes in Bitcoin’s value could have a ripple effect across the entire market. Traders and investors will need to closely monitor these developments to capitalize on potential opportunities or mitigate risks.

In conclusion, the latest Bitcoin halving event has the potential to reshape the cryptocurrency market in the long term. By reducing the rate of new coin creation and increasing scarcity, the halving could drive up demand and prices. Miners will need to adapt to the changing landscape, and the broader market may experience fluctuations as a result. Overall, the implications of the latest Bitcoin halving are likely to be felt for years to come.